Mn Gambling Permit

Registered nonprofit organizations may conduct lawful (charitable) gambling such as bingo, pull-tabs, tip boards, and paddle tickets. Some food or bar establishments lease or grant space to these organizations.

- Mn Gambling Raffle Permit

- Mn Gambling Permits For Raffles

- Mn Gambling Permit Number

- Mn Gambling Permit Application

- Mn Gambling Permits

These activities are subject to the state’s Lawful Gambling Tax (but not sales tax).

For more information:

Liquor distributors and liquor stores must have a liquor license to sell alcoholic products in Minnesota. Licensing Information Minnesota Department of Revenue COVID-19 Penalty Relief: You may ask us to cancel or reduce filing or payment penalties if you have a reasonable cause or are negatively affected by the COVID-19 pandemic. About 1,400 Minnesota organizations are licensed to conduct gambling at about 3,300 different locations. Regulating Charitable Gambling. Charitable gambling is regulated by the seven-member Lawful Gambling Control Board. It licenses organizations and gambling managers and makes rules for the conduct of gambling.

- See Gambling Taxes

- Visit the Gambling Control Board website

- Call the Gambling Control Board at 651-539-1900

A retail sale is:

- The sale, lease, or rental of tangible personal property

- The sale of tangible personal property used in conducting lawful gambling under chapter 349 or State Lottery under chapter 349A and is not considered a sale of property for resale

The table below explains when sales tax applies to the sale of gambling devices and equipment.

| Question | Is the Item Taxable? | References |

|---|---|---|

| Is the rental of electronic gaming devices taxable? | Yes. The lessee is responsible for the sales tax on the rental or lease of the equipment. It does not matter if there is a revenue sharing agreement. |

|

| Are monthly equipment charges taxable? | Yes. The lessee is responsible for the sales tax on the rental or lease of the equipment. |

|

| Are revenue sharing agreements taxable? | Yes. The lessee is responsible for the sales tax on the total sales price of the rental or lease of an electronic gaming device – even when the sales price is separated into various components. |

|

| Are bingo cards and pull-tabs taxable? | Yes. The retailer is responsible for the sales tax unless an exemption applies – including purchases of digital products. |

|

| Are electronic pull-tabs taxable? | Yes. The retailer is responsible for the sales tax unless an exemption applies – including purchases of digital products. |

|

| Are apps for electronic gaming devices taxable? | Yes, they are taxable when sold to the distributor. |

|

| Is the sale of the software taxable? | Yes, they are taxable when sold to the distributor. |

|

| Does local sales and use tax apply when the city also has a local gambling tax? | No. However, Minnesota sales tax (6.875%) still applies. |

|

| Are purchases of gambling equipment by a 501(c)3 organization with a gambling license taxable? | Yes. These organizations must pay sales tax when they purchase, lease, or rent gambling devices and equipment. |

|

If you have any questions, email us at salesuse.tech@state.mn.us.

Mn Gambling Raffle Permit

Exempt/Excluded Permit for Fundraising Events

Mn Gambling Permits For Raffles

COVID-19 Update for Exempt Activities (3/17/20)

- If holding raffle drawing as originally scheduled, you must still follow all lawful raffle conduct requirements plus any health advisory requirements.

- If delaying drawing date or moving drawing location, please email your Licensing Specialist with your permit number, location, and original date of your postponed activity. Publicize the delay of the raffle so people who may have purchased raffle tickets understand the reason for the delay. Your organization will have up to one year from the original date of the permit to reschedule your postponed activity date. Once the information is complete on when and where your event will take place, send the new information with an appropriate signature from the local unit of government acknowledging the activity, and signed by your CEO, to your Licensing Specialist. A new permit will be reissued to your organization with the updated information.

- If you intend to cancel a raffle, your organization will need to return any money received from sales of raffle tickets.

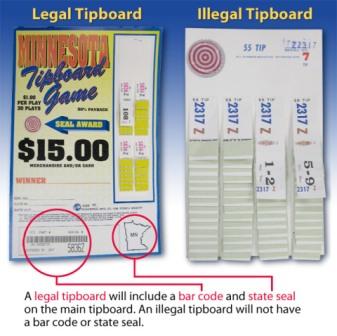

If you have purchased any other gambling equipment such as pull-tabs, tipboards, or paddlewheels and paddletickets, make sure that this equipment is properly secured with invoices until such time as it will be used. You may also be able to return unused equipment to the licensed distributor your organization purchased the equipment from.

Please direct any questions to your Licensing Specialist via email. This will ensure a quicker response than a telephone call at this time.

END OF UPDATE

_____________________________________________________________________________________________________________________

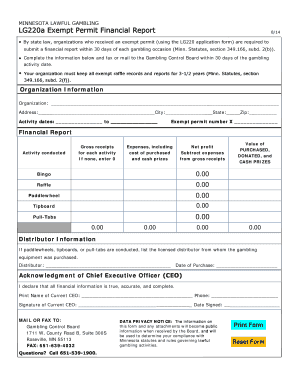

The following information pertains to registered nonprofit organizations seeking to conduct bingo, raffles, and other forms of lawful gambling by excluded or exempt permit as allowed by Minnesota law.

You will need to determine for the calendar year:

Mn Gambling Permit Number

- what type of gambling you will be conducting,

- how many events will be conducted (for raffles, the event date is the drawing date), and

- the estimated total market value of all donated and purchased prizes to be awarded.

Mn Gambling Permit Application

An organization may not conduct both exempt and excluded activity in the same calendar year.

Mn Gambling Permits

Forms and information for the conduct of raffles, bingo, pull-tabs, tipboards, and paddlewheels.